inherited annuity tax calculator

The annuities would not have an RMD if your father purchased them himself from an insurance company. The same options apply to spousal inherited annuities but with one additional option spousal continuance.

Annuity Beneficiaries Inheriting An Annuity After Death

Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

. You will only pay income taxes on the earnings if its a non-qualified annuity. Build Your Future With a Firm that has 80 Years of Investment Experience. Options for People Who Are Not the Surviving Spouse.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. The earnings are taxable over the life of the payments. Total distribution in box.

When you inherit an annuity the tax rules are similar to everything described above. Tax Consequences of Inherited Annuities. Ad Fixed Annuity Can Provide a Very Secure Tax-Deferred Investment.

A tax-qualified annuity is one. When an annuity payment is made 50 of each payment would be income taxable. For non-IRA inherited annuities you can receive payments either a single life based on.

Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Calculate the required minimum distribution from an inherited IRA.

In exchange for this transaction the beneficiary will receive a one-time lump sum payment. If you have an inherited annuity and are interested in selling it CBC Settlement Funding can provide. A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan.

Federal tax law only imposes an estate tax on wealth passed down at death. Payments can be spread. Tax Rules for Inherited Annuities.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Ad Learn More about How Annuities Work from Fidelity. As someone other than the surviving spouse you will basically have three potential options.

Spousal continuance will allow the surviving spouse to. This is a one-time lump sum payout upon the death of the annuity owner or annuity owners. Your wife inherited her mothers annuity.

If you opt to receive a lump-sum payment of all. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed.

If the annuity owner still had ownership when he died the value of the annuity is included in his. Different tax consequences exist for spouse versus non-spouse beneficiaries. Ad Learn More about How Annuities Work from Fidelity.

If youre the spouse of the. Learn some startling facts. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments.

So for instance if the annuity has 50000 in gains and 50000 in principal you wont receive the tax-free principal until after youve received all of the gains. Unlike other investments the named beneficiary of a nonqualified annuity does not get a step-up in tax basis to the date of death. Qualified annuity distributions are fully taxable.

You will pay taxes on the full withdrawal amount for qualified annuities. It sounds like she received the remaining balance so the 1099-R is probably marked as. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received.

You should receive a Form 1099R Distributions from Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc from the payer of the lump. Ad Annuities are often complex retirement investment products. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

However that doesnt mean the beneficiary will have. In turn taxation of annuity distributions. Surviving spouses can change the original contract.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. These payments are not tax-free however.

RMD applies to a traditional IRA or a qualified retirement plan.

Inherited Annuity Tax Guide For Beneficiaries

How Does Inheriting An Annuity Work Smartasset

The Best Annuity Calculator 17 Retirement Planning Tools

The Best Annuity Calculator 17 Retirement Planning Tools

1 529 Inherited Photos Free Royalty Free Stock Photos From Dreamstime

Annuity Taxation How Various Annuities Are Taxed

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities4-2813a92710984e7da733f6c5b924d0fb.png)

Calculating Present And Future Value Of Annuities

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Inherited Annuity Commonly Asked Questions

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

Taxation Of Annuities Ameriprise Financial

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Taxation How Various Annuities Are Taxed

Making Annuity Inheritances More Tax Efficient

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Distribution Options For Inherited Non Qualified Annuities Bsmg Brokers Service Marketing Group

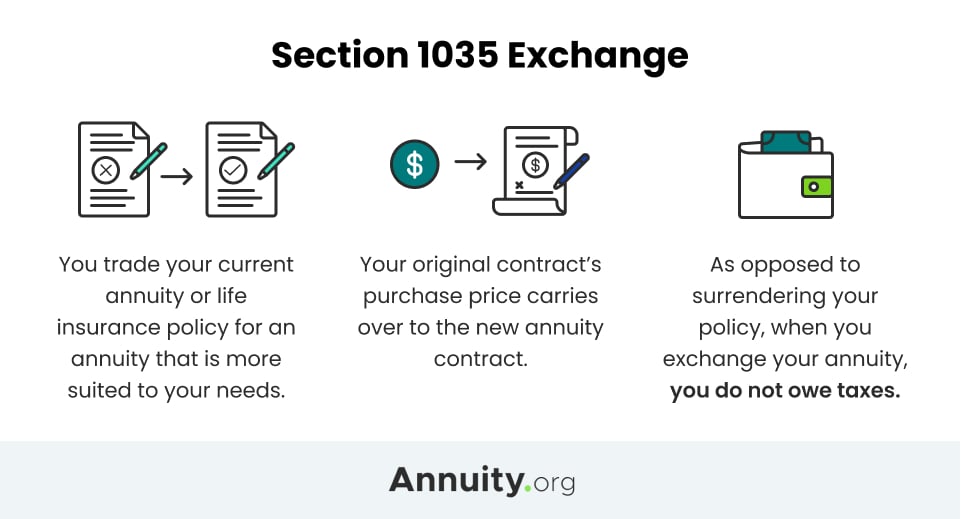

1035 Annuity Exchange Swapping One Annuity For Another

Inherited Non Qualified Annuities For Spouses Non Spouses And Trusts