pay indiana unemployment tax online

For best search results enter a partial street name and partial owner name ie. You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers.

Irs Credit Reduction State For 2021 Schedule A Form 940

You can apply for an EIN at IRSgov.

. You also can file a wage report online or adjust a filed wage report online. See Departmental Notice 2 for more information. File online using IN Tax.

Registering for an Indiana State Unemployment Tax Account. The Indiana Department of Workforce Development DWD is seeing increased incidents of fraud in UI programs. Once registered with the Indiana Department of Revenue they will issue the WH-1s and determine the filing status.

The WIOA State Plan is designed to provide. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Please use the following steps in paying your.

If you cannot locate this number please call the agency at 317-233-4016. Those who used tax preparation software or online services to file prepare returns for mail-in or file electronically should check to see that the company updated its software to add back unemployment. Yes No Please Enter Your FEIN.

If you do not have a FEIN get a FEIN now. Pursuant to 20 CFR 60311 confidential claimant unemployment. Form WH-3 Annual Withholding Tax.

These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July. Unemployment Insurance is a program funded by employer contributions that pays benefits to workers who are unemployed through no fault of their ownPlease use our Quick Links or access on the images below for additional information. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one.

Through the Uplink Employer Self Service System you have access to on-line services 24 hours a day 7 days a week. I need to file my 2020 Indiana individual income tax return and plan to file electronically or prepare my tax return using tax softwareonline services. Unemployment Tax Payment Process.

This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems. Effective June 1 2022 the gasoline use tax rate in Indiana for the period from June 1 2022 to June 30 2022 is 0240 per gallon. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD.

Search for your property. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one. 124 Main rather than 124 Main Street.

To establish your Indiana UI tax account youll need a federal employer identification number EIN. Search by address Search by parcel number. Do you already have an existing Indiana DWD account number for the account type selected above.

Online filing information can be found at wwwUnemploymentINgov. Indianas 2020-2023 WIOA State Plan. Electronic Payment debit block information.

The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services. Register online with the. Up to 25 cash back Note.

Online Payment Service by VPS. Register with the Indiana Department of Revenue. Business entities that have paid wages in Indiana and met employer qualifications are required to register with the Indiana.

Submit quarterly unemployment insurance contribution reports. To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments.

Pin On Mntaxpros Roggenkamp Tax And Accounting Preparation Bookkeeping Payroll

Ways To File Taxes For Free With H R Block H R Block Newsroom

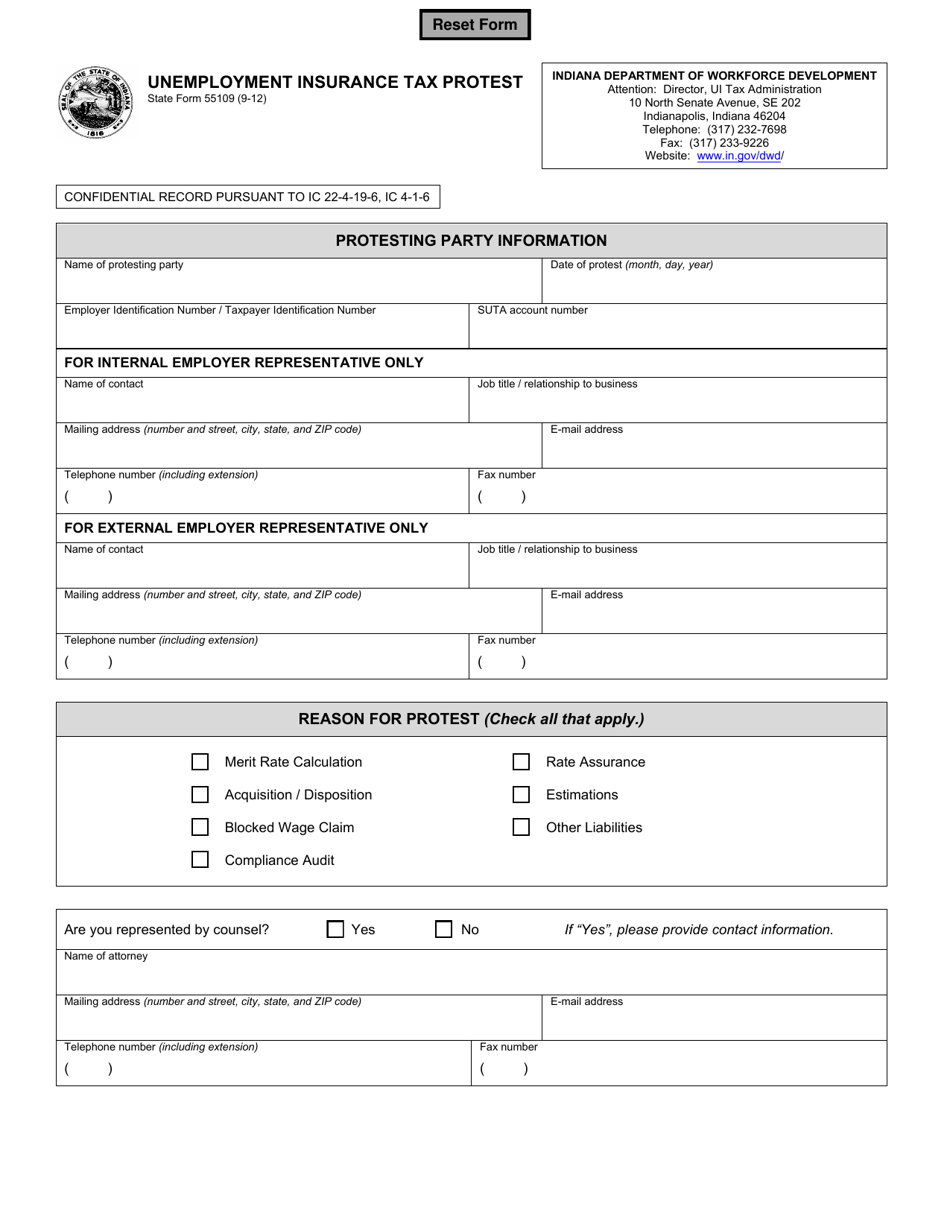

State Form 55109 Download Fillable Pdf Or Fill Online Unemployment Insurance Tax Protest Indiana Templateroller

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Ess Employer Self Service Logon

Deluxe Online Tax Filing E File Tax Prep H R Block

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Freetaxusa Review Pros Cons And Who Should Use It

Social Engineering Red Flags Peer Pressure Social Engineering

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

How To Do Your Taxes In 2022 Cbs News

Today S Front Pages Newseum Newseum Social Icons Newspaper Front Pages

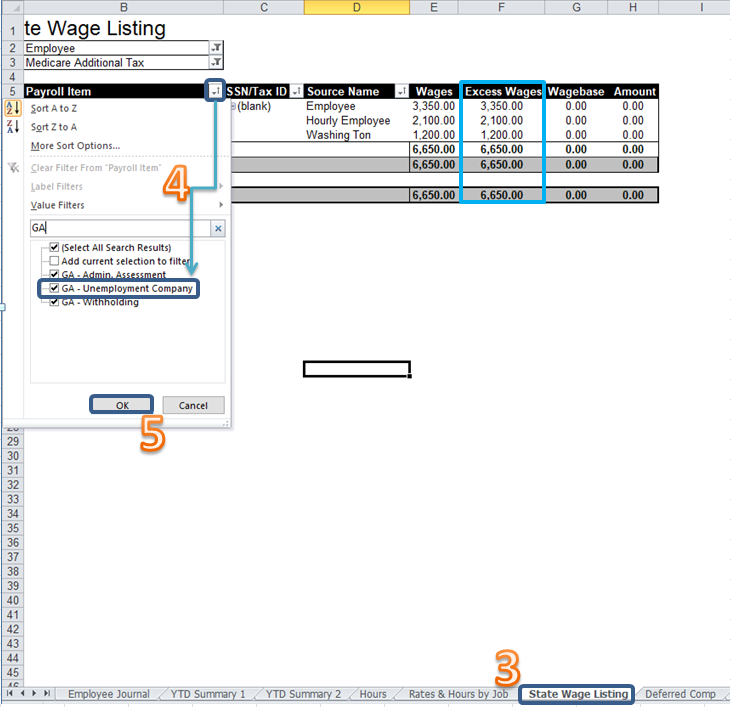

Solved Creating State Sui E File

H R Block Review 2022 Pros And Cons

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Secure Login Access Http Www Netankiety Pl The University Alliance Login Here Secure User Login To Univers Places To Visit I Am Awesome Interesting Reads